Trucks are the backbone of the American economy. With nearly 11 billion tons of freight moved throughout the US by trucks in 2021, most items that Americans consume were in a truck at one point. They also make roads much more dangerous.

There are a plethora of rules and safety regulations to make trucking safer. But when an accident happens, injuries and fatalities are much more severe. Verdicts and settlements in these cases can be much larger than in standard auto accident cases.

At first glance, there are several factors that seem to make trucking accidents more straightforward than standard auto accident cases. With guaranteed insurance coverage, you won’t hit a dead end a few months into the case.

There’s also much less work needed to resolve jury bias against your client; while juries might be quick to lay blame for standard auto accidents, most people are familiar with the fear and discomfort of driving near large tractor-trailers. Additionally, the myriad of regulations and statutory responsibilities that govern trucking companies creates many opportunities for targeting specific statutory standards that were broken.

While that might make trucking accidents look like an easy win, they are anything but. For every bottle of milk delivered to your local grocery store, there are a variety of businesses, roles, and legal responsibilities of the parties along the supply chain.

These entities and the relationships between them result in a surprising web of complex legal protections that can quickly dismantle your case. However, by understanding the hidden layers of liability and knowing how to fight the “broker” defense, it’s possible to win maximum coverage for your client with a settlement or verdict that can be nearly ten times higher.

Here’s how.

A Breakdown of the Trucking Industry

Identifying responsible parties can get complicated. The key players in the trucking industry can generally be defined as: shippers, brokers, motor carriers, and drivers.

Shippers refers to the party that supplies goods to a motor carrier or driver of a commercial vehicle for transport.

Brokers are people or entities that arrange or offer to arrange the transportation of goods by a motor carrier for a fee.

Motor carriers transport goods for a fee and can also be responsible for the motor carrier number assigned to each vehicle as issued by the Department of Transportation.

Drivers are employees or contractors who operate commercial motor vehicles.

The relationship between these entities can become incredibly complex. Due to the difficulty in defending trucking cases, many big corporations attempt to eliminate their liability by adding layers between themselves and drivers. Many large motor carriers and big box retailers will pass off shipments to small, local carriers that have much less coverage. These small carriers have the motor carrier numbers issued in their name, and thus an obvious legal responsibility and relationship to the driver.

Federal Aviation Administration Authorization Act of 1994 (FAAAA)

While we have defined the term, ‘motor carrier’ above, the legal definition is much more contested. Although the FAAAA was passed in the 90’s, many retailers and large motor carriers are leveraging it in recent years to reduce their liability by defining themselves as ‘brokers’. Under certain interpretations of the FAAAA, brokers can’t be liable for the negligent selection of a driver, and any liability is preempted by the federal government.

With the technical advancements that make remote monitoring of drivers easy, big corporations are able to gather driver data and exert control over drivers without ever speaking to them. Claiming that they are just “brokers” is possible because no direct contact is ever required while the sheer amount of data being collected makes it simple for them to get the feedback and results they want. The key to overcoming this act is to show that these retailers and large motor carriers retain and exert almost total control of the shipping cycle, yet refuse to accept reponsiblity typical motor carriers have under federal law.

Tackling the “Broker” Defense

While the contracts between large corporations and small motor carriers might state that they don’t manage drivers, the reality on the ground often indicates otherwise. With many rules, operational guidelines, and instructions being set by the big corporations that small motor carriers are legally bound to enforce, the local motor carrier simply acts as a megaphone.

Tackling the broker defense requires alleging the case correctly in the complaint, with alleging vicarious liability involvement due to the control and supervision that these large corporations actually exert. It’s essential to ask witnesses about third-party involvement and use depositions to paint an accurate picture that shows which parties are in fact pulling the strings.

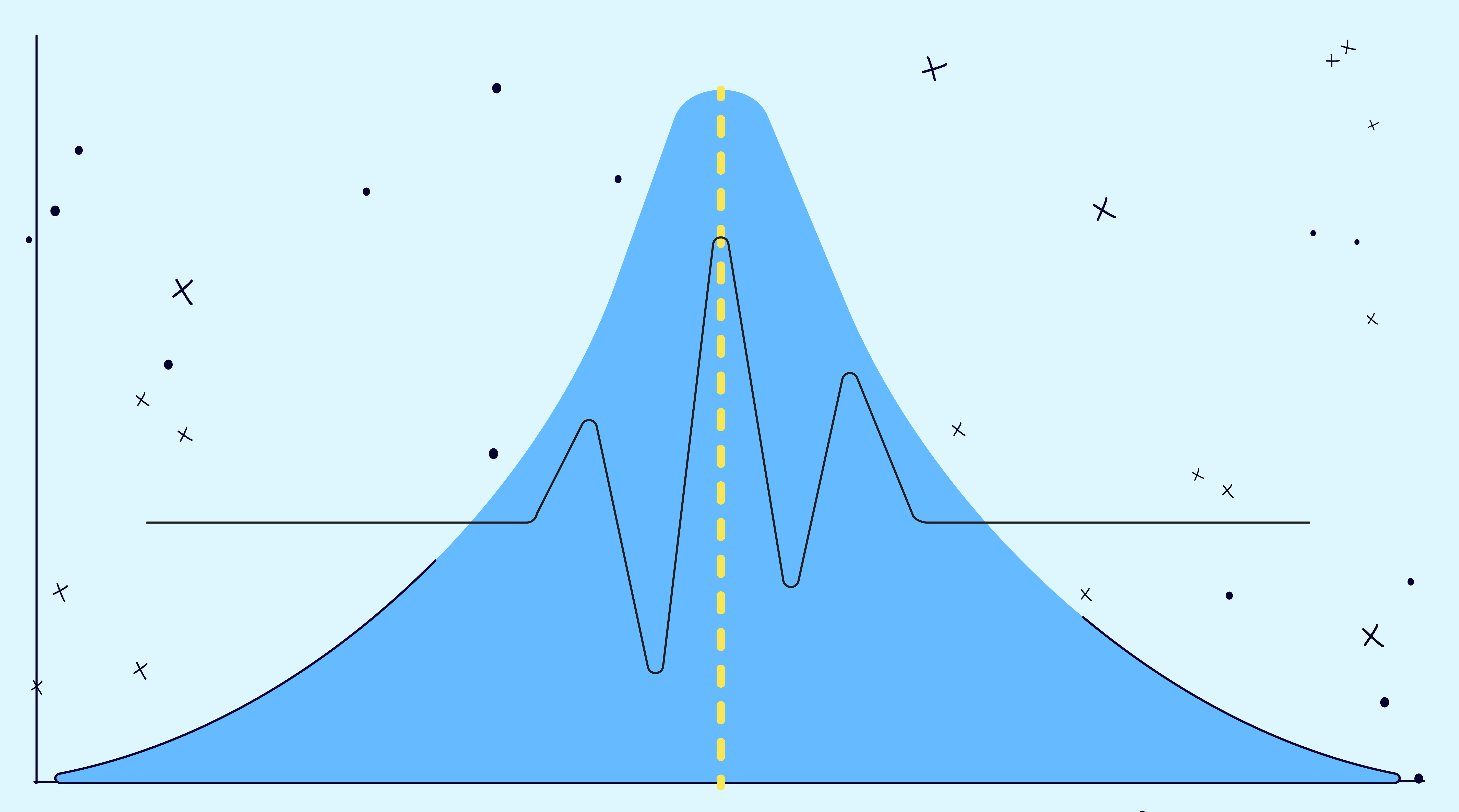

Additionally, the driver data that big corporations collect can be used against them. With information like time on the road, speed, and trips being on record, dangerous drivers can be easily identified. Negligently selecting an independent contractor is something they can be held accountable for.

Winning Big

Trucking accident settlements and verdicts can be incredibly valuable. Getting maximum coverage for your client requires unraveling layers of contracts, relationships, and following the money until the ultimate responsible party is identified. Motor carriers and retailers may also be misleading with the amount of insurance available, so working to verify all coverage is essential.

Being successful requires experience writing the motions, arguing the hearings, and knowing the plays the defense will make. While this article covers motor carriers and retailers, it doesn’t end there. With the maintenance requirements on trucks, mechanics and fleet maintenance companies might also be liable in the event of an accident. Additionally, trends indicate a continued increase in technical components and self-driving technology on trucks, adding a product liability component that will become increasingly relevant in trucking accident cases.

No settlement amount is enough to reverse the impact of a trucking accident. But making sure that no stone is left unturned in holding all parties accountable can ease the burden.

With CaseWorth, the team at Morgan & Morgan can help you identify the value of a case. If you have a trucking accident case and want to know its potential value, share more information here.